Welcome To 2022 – Likely Another Year Of Commodity Price Volatility

Crude Oil:

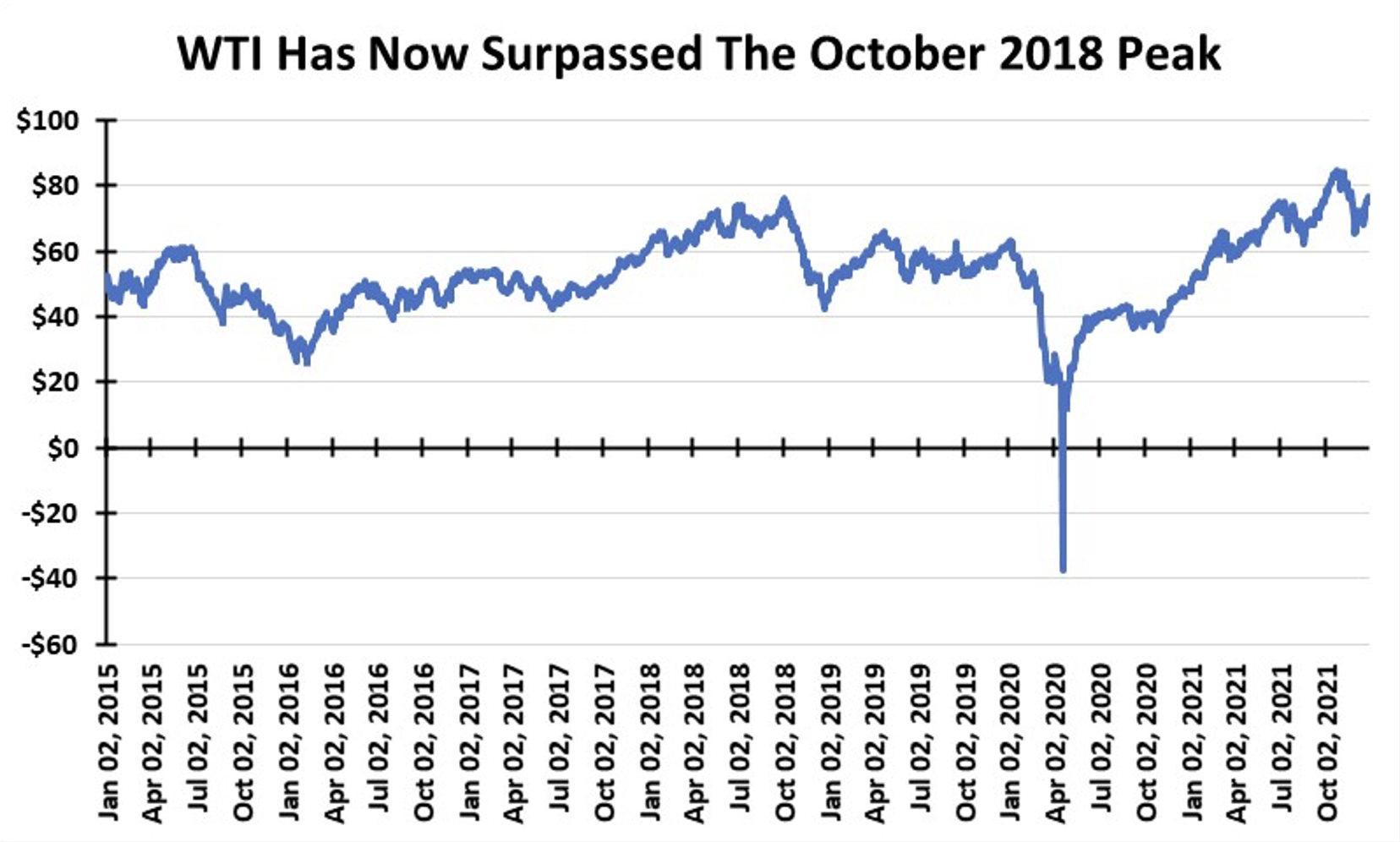

U.S. crude oil led all commodity prices higher in 2021, rising 58 percent. That was not surprising given the strong rebound in global economic activity, including a sharp increase in air travel. Demand growth outstripped the industry’s ability or desire to boost production, as concerns over virus upticks and environmental, social, and governance (ESG) pressures spooked managements about the long-term future of their business.

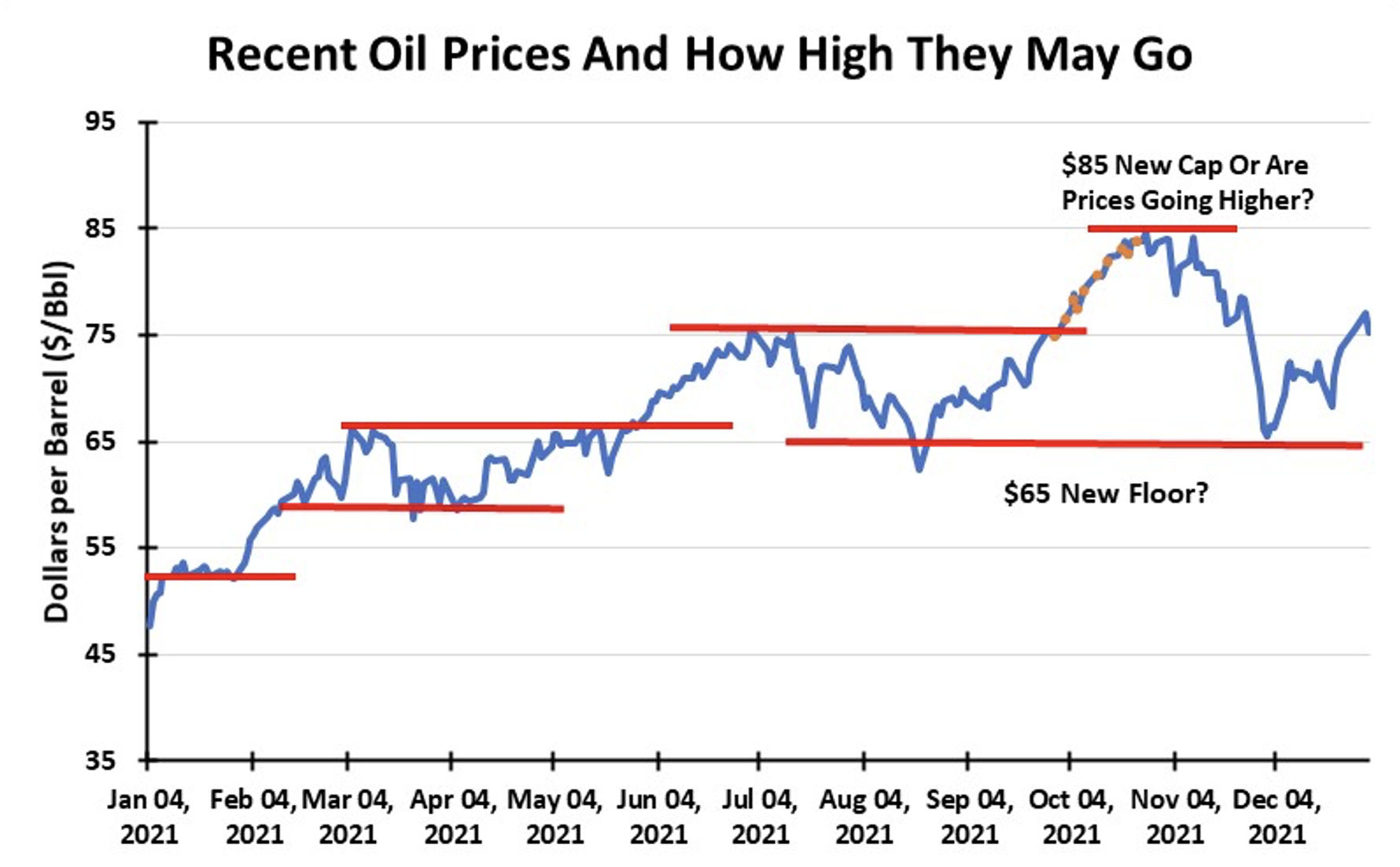

Today, WTI sits at about $80 per barrel, already up six percent since New Year’s Eve, as the Omicron variant, while more easily transmissible, is proving to be less severe, and thereby is expected to have less of an impact on oil demand than experienced in prior variant outbreaks during the past two years. While the future of oil demand is always a question mark, focus is now shifting to global supply and whether it can meet the projected consumption increases. Catalysts that may influence oil prices in 2022 largely involve geopolitical events and are almost evenly divided between positive and negative outcomes.

Today, WTI sits at about $80 per barrel, already up six percent since New Year’s Eve, as the Omicron variant, while more easily transmissible, is proving to be less severe, and thereby is expected to have less of an impact on oil demand than experienced in prior variant outbreaks during the past two years. While the future of oil demand is always a question mark, focus is now shifting to global supply and whether it can meet the projected consumption increases. Catalysts that may influence oil prices in 2022 largely involve geopolitical events and are almost evenly divided between positive and negative outcomes.

Factors that could positively impact oil prices in 2022, and possibly send them to $100 or greater levels, include: Russia’s political moves; possible political instability in Saudi Arabia with an aging king; Chinese Asian expansionism; U.S. environmental and infrastructure legislation; U.S. oil production; COVID-19’s trajectory; and inflation. Of these factors, the one that is not on many radar screens is the potential for Saudi Arabia to experience a leadership struggle if, and when, 86-year-old King Salman passes. Such an event would reverberate throughout OPEC, potentially creating political instability within the Middle East region, and altering Saudi’s relations with its Western Allies. Anyone or all three of these outcomes would have profound repercussions within the global oil and gas industry.

On the negative side of the oil price leger, we would list the following forces: diplomatic developments with Iran; President Biden’s relaxation of regulations on energy; a Republican sweep of the midterm elections; U.S. production and exploration growth; the cohesion of OPEC+, and China’s oil imports. The most revolutionary event would be a surprise relaxation of energy regulations, but with an event probability we would rank extremely low. In fact, for many, such a surprise would be considered a Black Swan.

On the negative side of the oil price leger, we would list the following forces: diplomatic developments with Iran; President Biden’s relaxation of regulations on energy; a Republican sweep of the midterm elections; U.S. production and exploration growth; the cohesion of OPEC+, and China’s oil imports. The most revolutionary event would be a surprise relaxation of energy regulations, but with an event probability we would rank extremely low. In fact, for many, such a surprise would be considered a Black Swan.

Implicit in these catalysts that would move oil prices is their impact on oil producer financial discipline. Producers have bent to the will of their shareholders to live within cash flows, deleverage balance sheets, limit reinvestment in exploration, and return more money to their owners. A financially stronger industry, in the face of sharply higher oil and gas prices, will have more cash flow available in 2022. Producers could boost their E & P budgets, while still increasing returns to shareholders, and likely not be punished in the stock market. Such a path could lead to meaningful U.S. oil output growth, something the world will need to avoid sharply higher oil prices in the longer-term. Current oil market conditions reflect a view that we are in the early innings of a traditional 5-7-year oil industry cycle, which should be good for participants and investors.

Natural Gas:

Natural Gas:

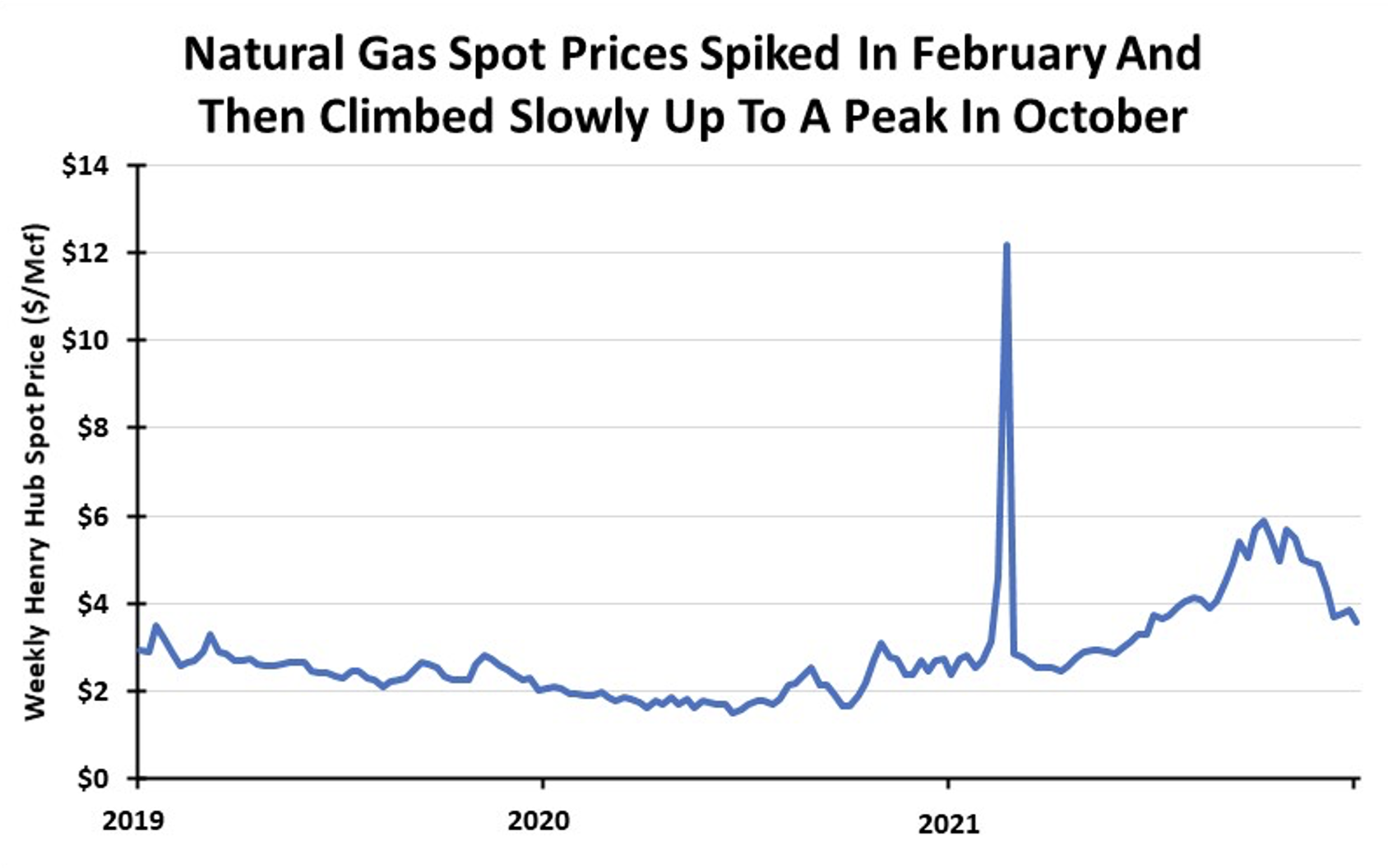

The final months of 2021 demonstrated to the world the importance of the global natural gas industry, and especially the role of the United States. The outlook for natural gas in 2022 sees the U.S. continuing its Superman role ensuring the electric power markets in Europe and Asia have sufficient supply. For natural gas, the last 12 months have shown that a fuel once dismissed as irrelevant in the global energy mix, is now the linchpin for ensuring that the lights stay on around the world.

The role of U.S. liquefied natural gas (LNG) in keeping the lights on cannot be understated. Shortly before Christmas, natural gas prices in Europe skyrocketed as early cold weather blasted the continent, limited gas storage volumes were aggressively drawn down, and Russia was slow to boost pipeline shipments. An energy crisis was under way! Dutch TTF natural gas futures for January delivery traded near €190 ($215) per megawatt-hour on December 21, up from €20 ($23) at the start of 2021, but importantly up from €80 ($90) at the start of December. The announcement that 15 LNG cargos from the U.S. were being diverted from Asian destinations to Europe in response to high gas prices caused the TTF price fell to €70 ($79) on New Year’s Eve. Amazingly, those LNG cargos would only supply roughly two and a half days-worth of European winter gas consumption. The TTF price collapse on the cargo news demonstrates the outsized impact of speculators who had been driving up European gas prices.

Since the price crash, European gas prices have jumped up again, as 2022 ushered in more cold weather, and Asian gas buyers were willing to pay more for LNG cargos. The TTF is now trading in the mid-€90s ($102s), up more than 35 percent in a matter of days!

Since the price crash, European gas prices have jumped up again, as 2022 ushered in more cold weather, and Asian gas buyers were willing to pay more for LNG cargos. The TTF is now trading in the mid-€90s ($102s), up more than 35 percent in a matter of days!

For the first time ever, in December the U.S. became the world’s largest exporter of LNG. Chinese and Japanese LNG buyers have arrived in the U.S. and are willing to negotiate long-term purchase agreements that support expansions and construction of U.S. LNG terminals. After decades of striving, the world is on the cusp of developing a truly global natural gas market, much like that for crude oil. What the gas market does not have, however, is a cartel like OPEC.

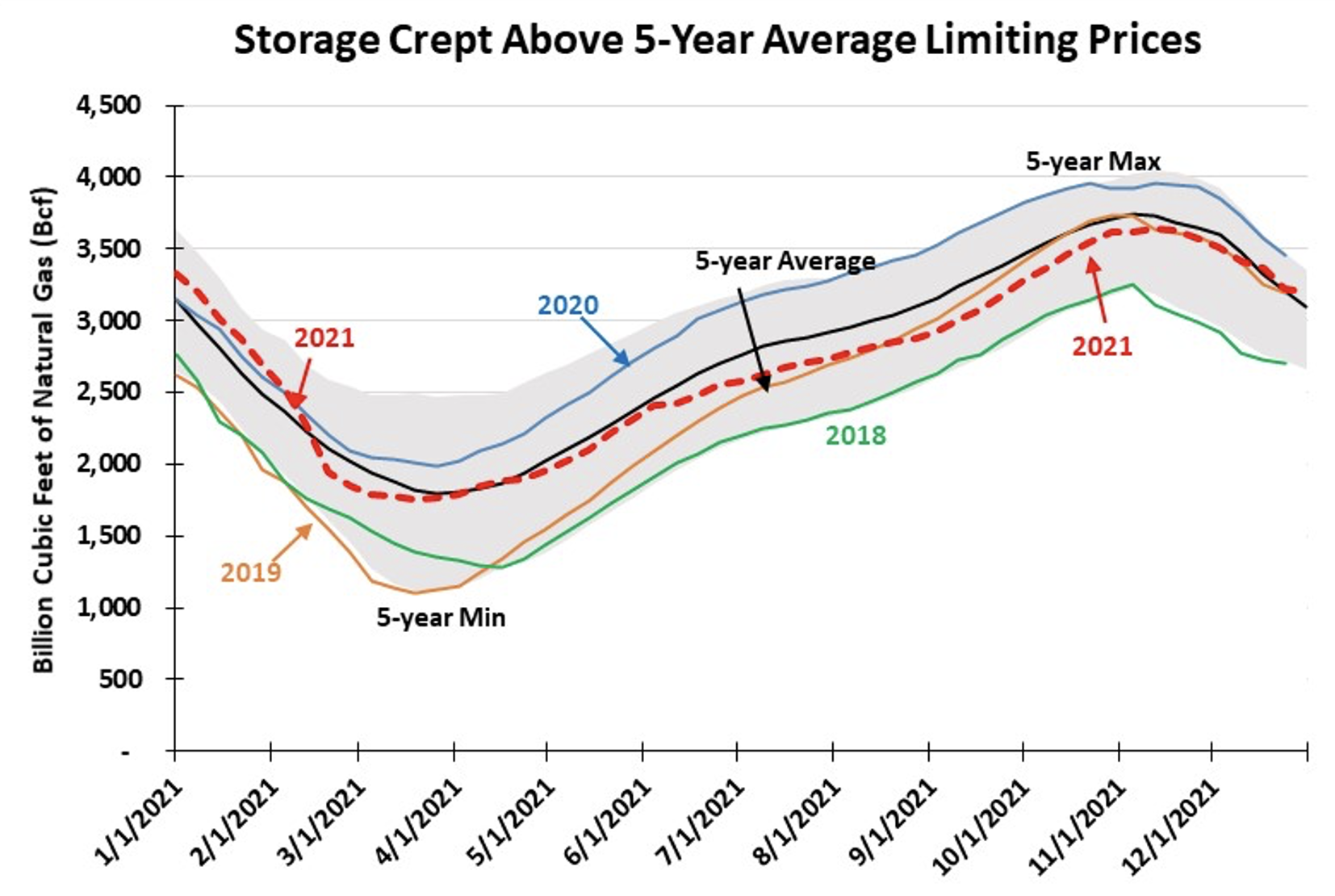

Natural gas demand in the U.S. is hitting a peak, supported by industrial demand along with LNG and pipeline exports. Weather will create consumption fluctuations, but overall demand should remain high this winter. Producers will need to step up gas drilling and boost associated gas production to meet this high level of demand. Better natural gas prices will help stimulate drilling activity, but producer response will still be governed by the adherence to financial discipline demands from shareholders. Is the U.S. poised for a higher level of sustainable gas prices?

Natural gas demand in the U.S. is hitting a peak, supported by industrial demand along with LNG and pipeline exports. Weather will create consumption fluctuations, but overall demand should remain high this winter. Producers will need to step up gas drilling and boost associated gas production to meet this high level of demand. Better natural gas prices will help stimulate drilling activity, but producer response will still be governed by the adherence to financial discipline demands from shareholders. Is the U.S. poised for a higher level of sustainable gas prices?

By G. Allen Brooks, Expert Offshore Energy Analyst & ON&T Contributor