The underwater inspection of marine equipment and subsea assets can be challenging and expensive. Traditional work-class vehicles, while larger, are not always the best solution for conducting offshore missions.

Features

All Stories

Researchers from NOAA, the state of Michigan, and Ocean Exploration Trust have discovered an intact shipwreck resting hundreds of feet below the surface of Lake Huron. Located within NOAA's Thunder Bay National Marine Sanctuary, the shipwreck has been identified as the sailing ship Ironton. Magnificently preserved by the cold freshwater of the Great Lakes for over a century, the 191-foot Ironton rests upright with its three masts still standing.

By G. Allen Brooks

In late June 2023, manned submersibles dominated the mainstream headlines, and not for the right reasons. This month’s esteemed guest, Will Kohnen, President & CEO of Hydrospace Group and the current Chair of MTS’ Submarine Committee, joined us to set the record straight on the unrecognized safety record of submarines.

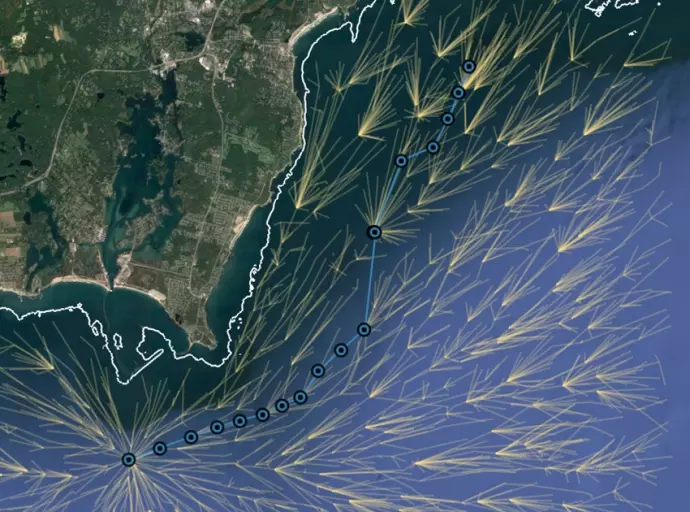

Utilizing surveillance data from dispersed and disparate sensors to know what's happening in the maritime domain is smart idea. The intelligent solution to deal with enormous amount of data is to leverage artificial intelligence. The US Navy's Task Force 59 has done exactly that during the recent Digital Horizon exercise.

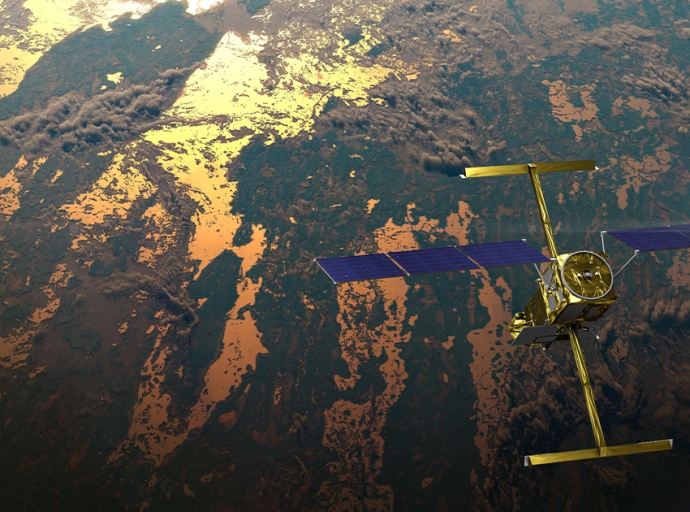

Cellula Robotics’ Solus-LR Autonomous Underwater Vehicle (AUV) offers game-changing features and capabilities for deep-sea research and exploration. Each individual component is important in its own right but when considered as a fully integrated system, the sum of this innovation-packed marine exploration platform is truly greater than its parts.