Oil & Gas Corporate Events Have No Impact on Commodity Prices

Crude Oil:

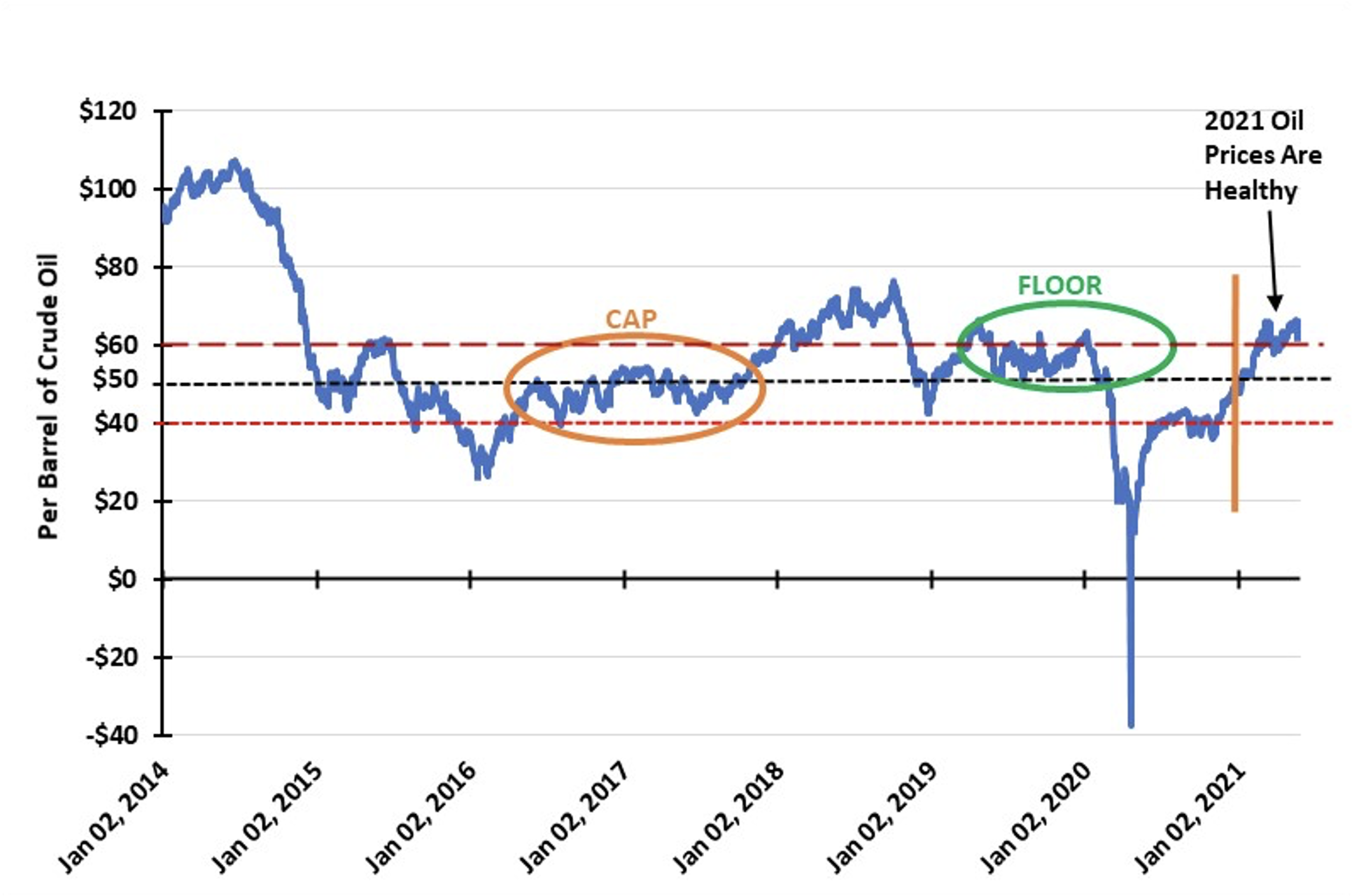

Since mid-February, except for a few days in early April, crude oil futures prices have been at or above $60 per barrel. The longer prices trade in this range, the greater the confidence that $60 has become the new price floor, meaning falling oil prices will reach that point and then rally higher. Price floors and caps are important technical levels for commodity traders figuring out when to buy and/or sell oil futures contracts. From the energy market’s viewpoint, the price floor is a signal we have reached a global oil supply/demand balance and are beginning to trend toward a shortage condition.

Another sign of the market’s balance and tightening environment on the horizon is that OPEC is adding more oil to the market. Importantly, the supply additions have not weakened oil prices as demand is growing despite COVID-19 outbreaks. The reopening of the global economy is key. Driving in North America has returned to 2019 levels and continues increasing. Air traffic grows and airlines are reporting leisure bookings are back to 2019 levels, although business traffic continues to lag. Shopping traffic is up sharply, although it is about 4.3% below 2019 levels. Companies, schools, and universities are announcing plans to return to in-person operations starting this summer and fall. All these demand increases are coming faster than predicted.

Another sign of the market’s balance and tightening environment on the horizon is that OPEC is adding more oil to the market. Importantly, the supply additions have not weakened oil prices as demand is growing despite COVID-19 outbreaks. The reopening of the global economy is key. Driving in North America has returned to 2019 levels and continues increasing. Air traffic grows and airlines are reporting leisure bookings are back to 2019 levels, although business traffic continues to lag. Shopping traffic is up sharply, although it is about 4.3% below 2019 levels. Companies, schools, and universities are announcing plans to return to in-person operations starting this summer and fall. All these demand increases are coming faster than predicted.

Geopolitics will continue to shape world oil supply. Will the Israel-Palestine violence, currently on hold, erupt and spread throughout the Middle East? Will the United States reenter the nuclear agreement with Iran, freeing it to ramp up its oil exports? Will the U.S. aid Venezuela in restoring some of its lost productive capacity? The answers to these questions, and others, could signal a greater increase in global oil supply. The offset is that additional consumption is shrinking the global oil glut from 2020 that overhung the market and depressed oil prices.

Rather than geopolitical events, global economic demand remains the key driver for oil prices. Will demand growth and limited supply expansion lead to an $80-per-barrel price by year-end, as Goldman Sachs predicts? While the loss of at least two directors from ExxonMobil’s board in a proxy contest suggests the end of Big Oil as we know it, the market knows we will need oil and its products for decades. That is why the shocking annual meeting outcome did not move oil prices. The market is smarter than the pundits.

Natural Gas:

Natural Gas:

Hurricane season begins June 1. The National Oceanic and Atmospheric Administration (NOAA) has predicted this year will see “above normal” activity—more total storms, hurricanes, and extreme hurricanes than usual. NOAA’s forecast is consistent with forecasts from other storm researchers. Colorado State University’s hurricane forecasters not only predict storm activity, they also have been developing models to predict where storms may go, including whether and where they might make landfall along the U.S. coastline and in the Caribbean. With an above-normal season predicted, it is not surprising that the likelihood of hurricane landfalls on the U.S coast is higher than the historical average.

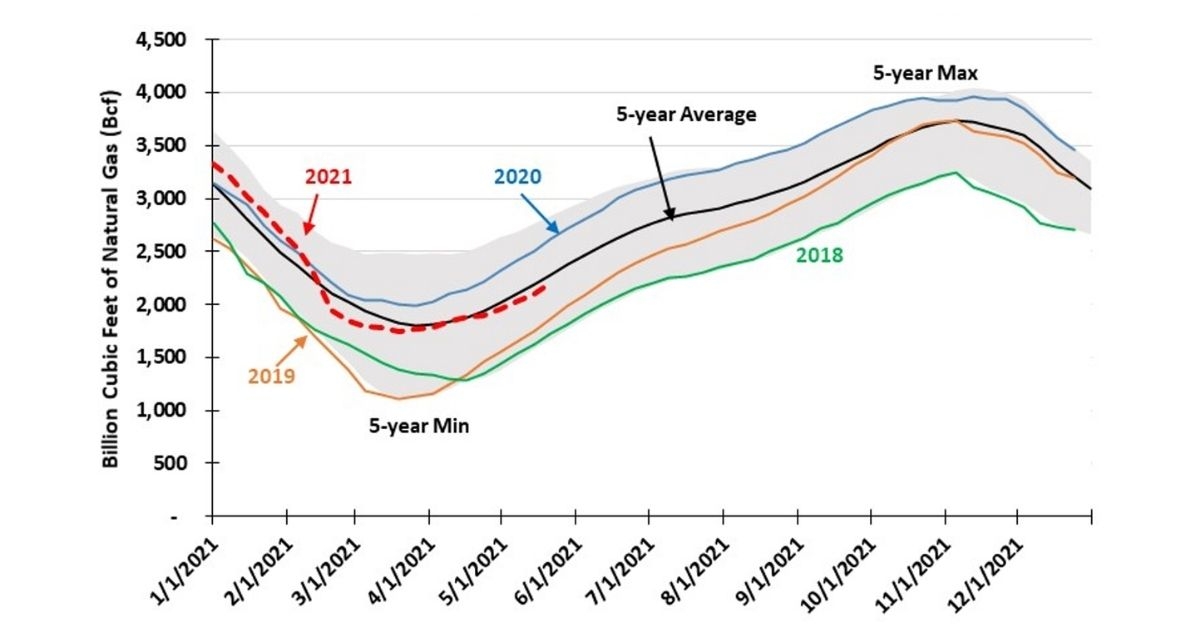

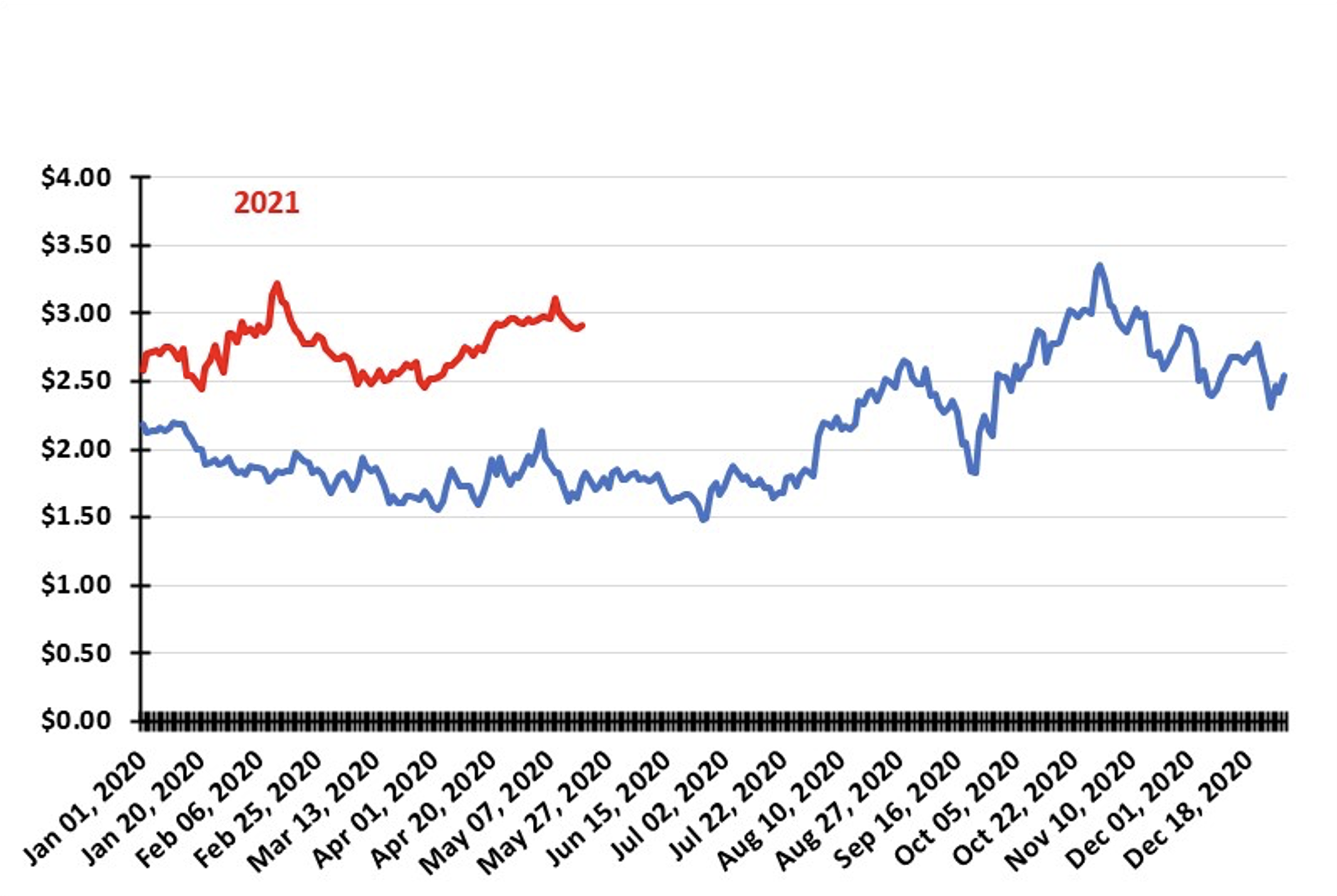

Weekly gas storage injections during May were higher than predicted. This is not necessarily a surprise, as we are in the shoulder months of weaker demand as we transition between winter and summer demand. Strong LNG demand is being met at the same time storage injections are overshooting estimates. This suggests consumption may be slightly weaker, while supply could be greater.

A healthy natural gas industry will be important in a recovering economy, but any spike in gas prices could jeopardize LNG’s global competitiveness. The completion of the Nord Stream 2 gas pipeline between Russia and Germany may make Europe a much more competitive market for U.S. LNG starting this fall, which is a longer-term development that needs to be monitored this summer. We also need to watch tropical storm activity for supply and demand disruptions.

Another potential disruptive development is the effort by politicians and courts to ban fossil fuels in fighting climate change. The recent ruling in The Netherlands by a Dutch court that Royal Dutch Shell must cut its carbon emissions by 45% from 2019 levels by 2030 is a sign of how market dynamics can be upset by events outside of the energy market. The ruling did not detail how Shell’s emissions were to be measured and monitored, let alone how the court would enforce its order or even what penalties might be assessed. The energy market sensed the ruling was another example of “virtue signaling” rather than a serious threat to gas demand, thus gas prices never reacted. This development is a warning that non-market events have the potential to disrupt gas prices by altering market participants’ expectations for supply and demand trends.

If natural gas supply is not disrupted by tropical storms and demand is not disrupted by non-market factors, gas prices will probably trade around their current levels. Extreme heat waves this summer will boost demand and could spike gas prices, but once the heat moderates, we would expect prices to return to their prior levels. A dull gas market is not such a bad situation.

By G. Allen Brooks

Featured in ON&T June 2021