Deepwater Downturn Leads To Challenging Marine Construction Market

By: Krystal Alvarez

New Oil Price Effects

The Upstream Supply Chain group at Wood Mackenzie has been closely following the repercussions of the past two years of depressed deepwater activity on operators, suppliers, and contractors. Ongoing adverse market conditions have incentivized operators to explore ways of making their prospective investments viable in the new oil price environment. As such, the industry is experiencing muted tender activity for deepwater installation services, which has left marine contractors dependent on their strong backlogs that are now nearly exhausted (Figure 1). Decreased deepwater demand coupled with the increased supply of vessels in the offshore subsea construction market segment have led to lower utilization rates in a deteriorating market, even with contractors divesting and stacking assets.

The downturn has severely affected several subsea vessel contractors who have been forced into Chapter 11 bankruptcy, including the most recent filing of Emas Chiyoda Subsea. Cecon ASA, Ceona, Harkand, and Reef Subsea are all marine contracting companies who have filed for bankruptcy, and many of which have been dissolved. The Ceona Amazon was recently acquired by McDermott for an estimated $52 million, which is a drastic discount compared to the $350 million it cost to build in 2014. The diminishing backlogs of marine contractors led to reduced day rates in 2016 for deepwater installation assets—and as tender activity remains uncertain and at low levels, we expect these rates to fall even further in 2017.

Figure 1. Tier One Marine Contractor Backlogs Q4 2011-2019e.

Preferred Operator Relationships

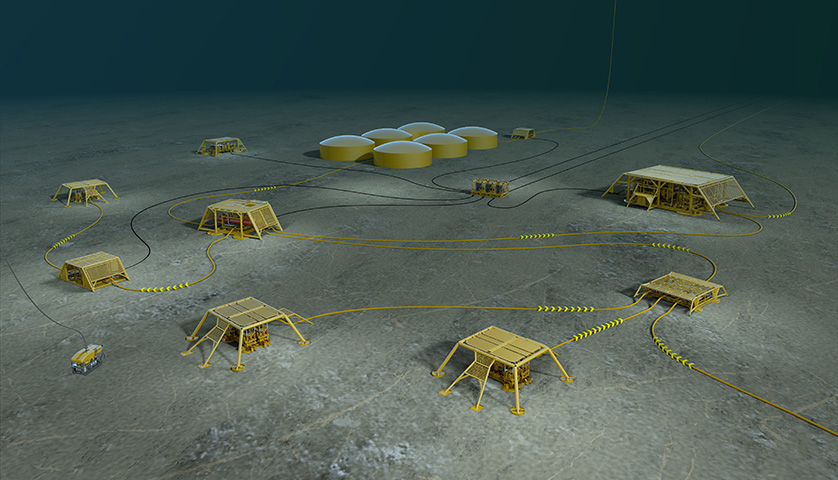

Top tier contractors such as Technip, Saipem, and Subsea 7 have formed critical alliances and built preferred contractor relationships with operators, which has strengthened their business during the ongoing downturn (Figure 2). Each of the three contractors has partnered or merged with a subsea equipment supplier, giving them the ability to design, develop, and provide integrated subsea development solutions. Technip and FMC Technologies have merged to form TechnipFMC, Subsea 7 and OneSubsea have partnered and formed a global alliance, and Saipem has partnered with Aker Solutions. As these contractors are working on the development of integrated SPS and SURF services, they have the opportunity through collaboration and the elimination of bottlenecks to establish better, more cost-effective ways to work together and with operators. There will be significant potential for integrated projects moving forward in the new lower for longer price environment.

Figure 2. Top 11 Operators Preferred Supplier Relationships – Project Award Count 2010-2017.

Solitaire pipe-laying vessel. Photo credit: Eva Sleire, Statoil.

There are many factors that drive operator's contracting strategies, including project location, complexity, and vessel preference; however, preferred contractor relationships play a large role. Based on the number of pipeline and umbilical project installation awards, Subsea 7 is the market share leader with 38% of the contracts from 2010 to 2017. Technip follows close behind with 36%. If you were to look at the same top 10 operators in Figure 2 but from a kilometre-of-pipeline-installed perspective, this graph would look different, with Allseas and Saipem having a larger share of the pie, given that a significant portion of their project portfolio includes installation of long export lines. Although operators now have the opportunity to contract one integrated contractor for subsea development solutions, these key relationships will still prove to be valuable when operators are considering project dynamics. We saw an example of this with ExxonMobil's Liza development where Technip- FMC was chosen for the subsea equipment supplier and Saipem as the installation contractor (Saipem is historically their preferred installation contractor).

Figure 3. Regional Marine Construction Demand in Kilometres, 2010-2022.

Marine Contracting Demand Forecast

Despite the harsh market conditions, African installation activity has increased from historical levels with planned installation activities for Total's Kaombo Phase 1, BP's Shah Deniz Phase 2, and the Turkstream Pipeline Project occurring in 2017. Installation in offshore Egypt is expected to increase relative to history on the heels of Eni's Zohr and BP's West Nile Delta Phase 2, among others. The Turkstream Pipeline will provide a drastic increase in demand for the region, with Allseas performing installation services for the two pipeline strings representing about 930 km each. The region has attracted many of the industry's high-end installation assets, including Technip's Global 1200 and Deep Blue, Saipem's FDS and Castorone, Heerema's Balder, and several others.

Global trunkline and export installation activity will provide upswing for the forecast period, with awarded installations of Gazprom's Turkstream Pipeline Project in the Black Sea, Total's Kaombo Phase 1 in Angola, BP's Shah Deniz Phase 2 in the Caspian, BP's Trans Adriatic Pipeline in the Adriatic, Petrobras' Rota Marica Pipeline Project in Brazil, Gazprom's Nord Stream 2 in the Baltic Sea, and CFE's Sur De Texas Tuxpan transmission line in Mexico which is contributing to North America's demand in 2018.

Global installation demand will account for over 40,700 installation demand days forecasted for 2017 to 2022, with Africa, Asia, and South America being the largest contributors to demand for all OD categories (Figure 3). Although a great portion of installation demand is driven by new project development, there is also opportunity in IMR (inspection, maintenance, and repair) demand, which encompasses a large variety of work on existing fields, ranging from visual inspection, testing, and the repair or replacement of components and pipeline infrastructure. The global subsea market has grown significantly over the past decade, leading to a growing installation base now exceeding 4,000 flowing subsea wells with accompanying pipeline infrastructure, providing opportunity for life of field activities. While operators navigate this new price environment and practice high levels of spending and discipline, IMR and workover activities can be economically beneficial and pay a return through increased production though market conditions remain challenging and timing of new awards to market remains uncertain.

While a slightly more optimistic outlook on deepwater FIDs in the coming years are a positive leading indicator for subsequent marine contracting, 2017 will likely mark the beginning of the trough for installation demand. Operators are working to increase efficiencies in their projects while suppliers and contractors work together to provide cost-saving subsea solutions. This collaborative effort within marine construction and across deepwater will be a significant driver to how strong we move out of this downturn into the next upcycle.

The analysis and insight provided in this piece are from our recently launched global upstream supply chain research team. Through acquisitions of Infield Systems and the Quest Offshore data & subscriptions business, Wood Mackenzie has created a strong, industry-leading foundation on which to build the comprehensive suite of upstream supply chain solutions and costs.